23.09.2021, 13:14

Acquisition of 75-Acre West Heathrow Development Site

The Aberdeen Standard Investments managed Airport Industrial Property Unit Trust (AIPUT) has completed the freehold acquisition of a 75-acre site to the west of Heathrow Airport.

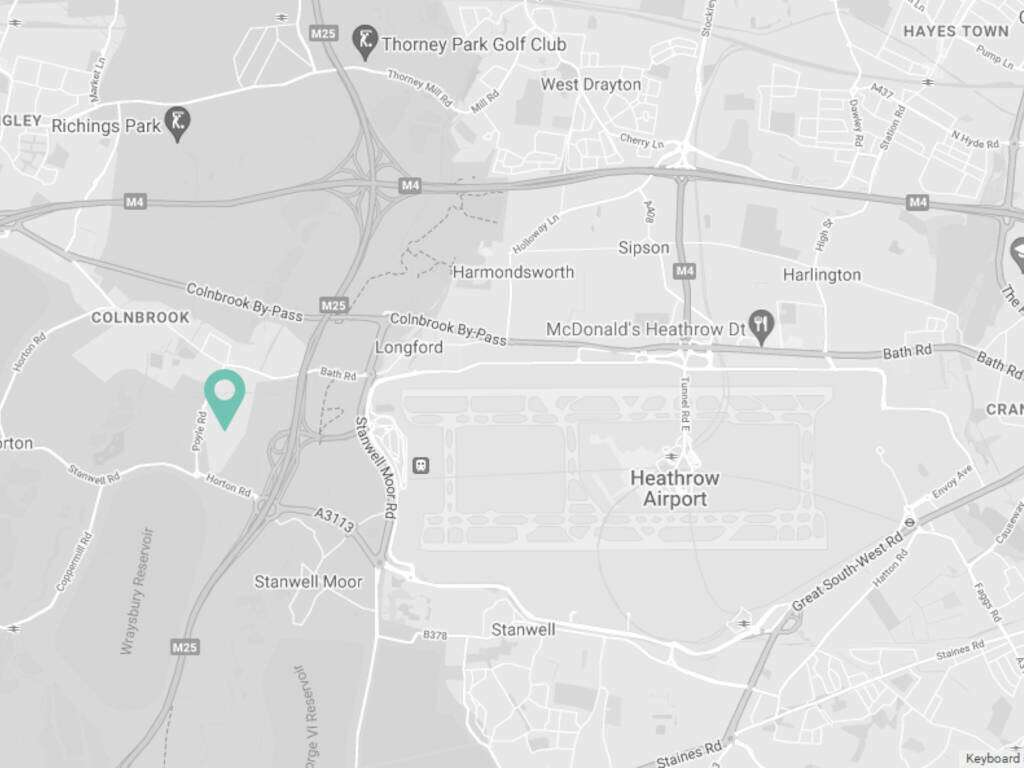

The acquisition of the development site which is adjacent to the Poyle Trading Estate and close to Junction 14 of the M25 and Junction 4B of the M4 represents the largest strategic land transaction in terms of acres in the area for over 20 years.

Enjoying quick access to Heathrow International Airport, west London and the Thames Valley, the site also benefits from an extensive motorway network and excellent public transport links providing access to the rest of the United Kingdom including the south coast ports. The location is also a significant supply chain hub at a time when policymakers are focusing on supply chain resilience.

This acquisition almost doubles the amount of land under AIPUT’s ownership around Heathrow Airport. It also represents a strong vote of confidence in Heathrow as a critical national infrastructure asset processing international trade and cross-border ecommerce, as well as a vitally important economic catalyst locally and across the wider south east and Thames Valley region.

The adjoining Poyle Trading Estate hosts AIPUT’s 155,000 sq ft (NIA) Blackthorne Point Industrial Estate, where construction of a new speculative 27,800 sq ft warehouse building is under way for delivery in Summer 2022. AIPUT’s existing customers at Blackthorne Point include UPS Supply Chain, Flostream Ltd and CH Robinson Worldwide.

Nick Smith, AIPUT Fund Manager, comments: “As a long-term responsible investor, AIPUT is dedicated to owning and developing exceptional industrial logistics real assets that set new standards in design and sustainability performance that are, above all, highly appealing to the modern occupier and its staff.

“Securing this substantial and uber-rare strategic site represents a huge opportunity for AIPUT to leverage our scale, expertise and meticulous research to elevate and diversify the portfolio at pace. Our ambition here is to deliver Heathrow’s next generation of highly efficient, secure and sustainable logistics warehouses that offer the best value in a highly competitive market driven by rapidly evolving consumer behaviour and technological advancement.

“Our immediate focus is to drive net income levels from the existing estate, whilst working collaboratively with all our neighbours and stakeholders to bring forward an exceptional redevelopment proposal that brings an extensive range of economic benefit for the region.”

AIPUT is a market-leading industrial property fund, representing a significant and attractive national infrastructure portfolio around London’s major international airports. The trust is currently ranked top of the AREF/PFI index, after delivering a total return of 27 per cent in the year to June 2021 despite challenges posed by the Covid-19 pandemic.

AIPUT was advised in the acquisition by Chappell King Aviation Real Estate, John Linton Property and Eversheds Sutherland.