The “City South” submarket benefits from its central location and excellent infrastructure, and has developed from a back-office location into an urban district which is very well connected to Hamburg city centre. (Tim Ulrich, Deputy Head of Transaction Management – Germany, Savills IM)

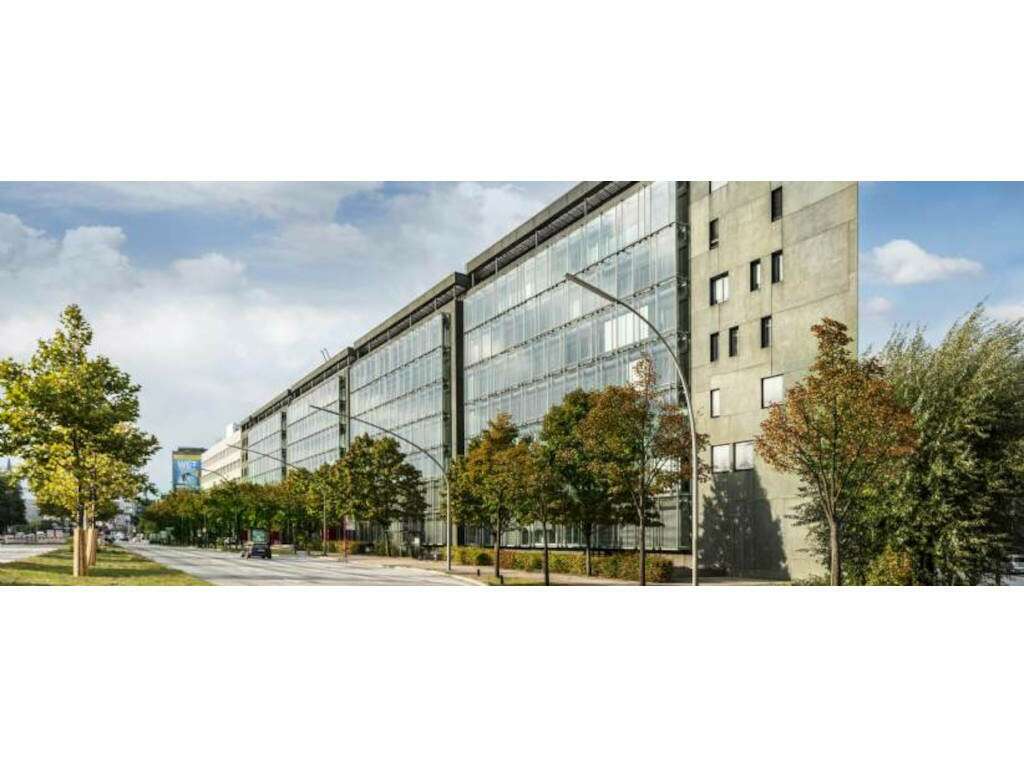

ABG Capital Acquires VTG Center, Hamburg

Institutional investment manager ABG Capital has agreed the acquisition of The VTG Center, a prominent multi-tenant office complex in Hamburg-Mitte, Hamburg from Savills Investment Management (Savills IM). One of 11 property holdings in the Savills IM Real Invest 1 fund – a closed real property institutional investment fund launched by Savills IM and three…

Institutional investment manager ABG Capital has agreed the acquisition of The VTG Center, a prominent multi-tenant office complex in Hamburg-Mitte, Hamburg from Savills Investment Management (Savills IM).

One of 11 property holdings in the Savills IM Real Invest 1 fund – a closed real property institutional investment fund launched by Savills IM and three German insurance companies in 2013, the development was built in 1996 to a design by Berlin-based architectural practice, léonwohlhage.

The VTG Center comprises four interconnected building sections with approximately 22,750 sqm of rental space laid out across eight floors, and boasts long-term tenants as well as excellent infrastructure connections in a location that is characterised by the heterogeneous use of residential, office and commercial buildings.

Tim Ulrich, Deputy Head of Transaction Management – Germany at Savills IM, says: “There is still a high demand for office space in Hamburg, as well as a low vacancy volume. Large spaces in particular have reduced availability which tightens supply, especially for large occupiers. The “City South” submarket benefits from its central location and excellent infrastructure, and has developed from a back-office location into an urban district which is very well connected to Hamburg city centre.”

Markus Bartelmeß, portfolio manager for the Savills IM Real Invest 1 fund, adds: “The VTG Center was acquired in 2015 for our real estate special fund. The transaction is the first sale of the fund. By selling at this point, we are realising the increase in value of the property for our investors.. The freed-up capital is to be reinvested promptly in modern, sustainable office properties.”

Savills IM were advised by Norton Rose Fulbright (legal), KPMG (tax) and CBRE (technical), with CBRE and JLL acting jointly as brokers.

Discover more from Estates Review

Subscribe to get the latest posts sent to your email.